Hey there, and welcome to our guide on credit scores in India! Whether you’re looking to apply for a loan or credit card, or just want to maintain a healthy financial profile, understanding your credit score is essential.

what is a credit score?

A credit score is a three-digit number that represents a person’s creditworthiness. In India, credit scores are calculated by credit bureaus such as CIBIL, Experian, Equifax, and CRIF Highmark, among others. These scores are used by lenders, banks, and other financial institutions to assess an individual’s ability to repay credit or loan.

The best article that will explain in detail:- Bank bazaar(Credit score)

Why do We Need to Maintain a good credit score?

- Loan Approval: One of the primary reasons to maintain a good credit score is to get loan approval easily. Lenders and banks look for a high credit score as it indicates a borrower’s creditworthiness and ability to repay the loan on time.

- Interest Rates: A good credit score also helps in getting better interest rates on loans and credit cards. Lenders offer lower interest rates to individuals with a good credit score, which can save a considerable amount of money in the long run.

- Credit Limit: A high credit score can also result in a higher credit limit on credit cards and other credit accounts. This can be beneficial for those who need access to a larger amount of credit.

- Employment Opportunities: In some cases, employers may check an individual’s credit score before hiring them. A good credit score can be a positive factor in getting a job, particularly in finance or banking.

- Insurance Premiums: Insurance companies may also check an individual’s credit score before deciding on insurance premiums. A good credit score can result in lower insurance premiums, saving money in the long run.

Maintaining a good credit score is crucial for getting loan approvals, better interest rates, higher credit limits, and even employment opportunities. It is recommended to regularly monitor and maintain a good credit score by making timely payments, keeping credit utilization low, and maintaining a diverse credit mix.

Types of credit report Agencies in India

In India, there are four main credit bureaus that provide credit reports and credit scores to individuals and businesses. These credit bureaus collect and maintain credit-related information on individuals and businesses from various sources, such as banks, financial institutions, credit card companies, and other credit providers.

Here are the four credit bureaus in India:

- Credit Information Bureau (India) Limited (CIBIL): CIBIL is the oldest and most popular credit bureau in India. It was established in 2000 and provides credit reports and credit scores to individuals and businesses. CIBIL collects credit information from over 1,000 member institutions, including banks, NBFCs, and credit card companies.

- Experian Credit Information Company of India Private Limited: Experian is a global credit information and analytics company that provides credit reports and scores to individuals and businesses. In India, Experian was established in 2006 and has tie-ups with over 600 financial institutions.

- Equifax Credit Information Services Private Limited: Equifax is another global credit information and analytics company that provides credit reports and scores to individuals and businesses. In India, Equifax was established in 2010 and has tie-ups with over 400 financial institutions.

- CRIF High Mark Credit Information Services Private Limited: CRIF High Mark is a credit bureau that provides credit reports and scores to individuals and businesses. It was established in 2007 and has tie-ups with over 1,000 financial institutions.

It is important to note that each credit bureau may have different information on an individual’s credit history, and their credit scores may also differ. Therefore, checking credit reports and scores from all four bureaus is advisable to ensure that the information is accurate and up-to-date.

How the credit score is calculated?

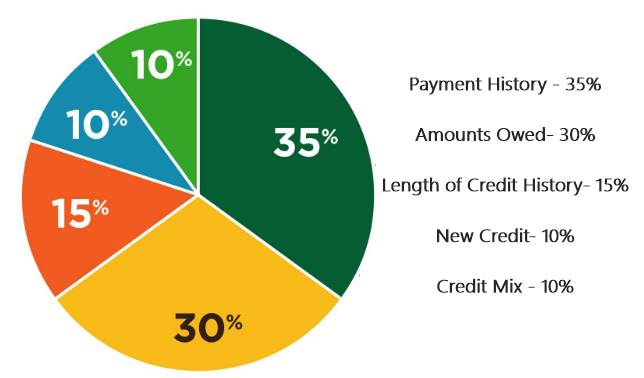

Your credit score is a vital factor in determining your financial credibility. In India, credit scores are calculated by credit bureaus such as CIBIL, Experian, Equifax, and CRIF Highmark, among others. These bureaus use complex algorithms to calculate your credit score, which takes into account various factors related to your credit history.

Image Source Link:- Website

Here are the factors that affect your credit score in India:

- Payment History Your payment history is the most crucial factor that determines your credit score. It shows whether you have made timely payments on your credit accounts or not. Any missed payments, late payments, or defaults will negatively impact your credit score.

- Credit Utilization Ratio Credit Utilization Ratio refers to the amount of credit you have used compared to the total credit available to you. If you have a high credit utilization ratio, it suggests that you are relying heavily on credit, which can negatively affect your credit score.

- Length of Credit History The length of your credit history also plays a significant role in determining your credit score. A longer credit history is seen as a positive factor, as it shows that you have a track record of managing credit responsibly.

- Credit Mix Having a diverse range of credit accounts, such as credit cards, personal loans, and home loans, can positively impact your credit score. It shows that you can manage different types of credit and are responsible for repaying them.

- Recent Credit Behavior If you have recently applied for multiple credit accounts or have taken on new debt, it may negatively impact your credit score. Lenders view this as a sign of increased financial stress and may consider you a higher-risk borrower.

Once the credit bureaus collect all the relevant data, they use their algorithms to calculate your credit score. The most commonly used credit score in India is the CIBIL score, which ranges from 300 to 900. A score above 750 is considered excellent, while anything below 600 is considered poor.

It is important to check your credit score periodically to ensure that it is accurate and up-to-date. You can get a free credit report from each credit bureau once a year. If you find any errors in your credit report, you can dispute them with the credit bureau to have them corrected.

In conclusion, your credit score plays a crucial role in determining your financial credibility in India. It is important to maintain a good credit score by making timely payments, keeping your credit utilization ratio low, and maintaining a diverse credit mix. Regularly monitoring your credit score can help you identify any issues and take corrective action to improve your score.

How to check credit score in India?

Checking your credit score in India is a straightforward process, and there are multiple ways to do it. Here are the four main ways to check your credit score in India:

- Online Credit Bureaus: You can check your credit score online by visiting the websites of credit bureaus such as CIBIL, Experian, Equifax, or CRIF Highmark. You will need to create an account by providing your personal and financial details, and then you can access your credit report and score. Some credit bureaus may charge a fee for this service.

- Third-Party Websites: There are also several third-party websites, such as BankBazaar and Paisabazaar, that allow you to check your credit score for free. You will need to provide some basic details, such as your name, date of birth, and PAN card number, and then you can view your credit report and score.

- Mobile Apps: Some credit bureaus and third-party websites have mobile apps that allow you to check your credit score on your smartphone. You can download these apps from the App Store or Google Play Store and create an account to access your credit report and score.

- By Post: You can also request a copy of your credit report and score by post. You will need to download the application form from the credit bureau’s website, fill in your details, and send it to the credit bureau along with a photocopy of your identity proof and address proof.

It is advisable to check your credit score regularly to ensure that it is accurate and up-to-date. A good credit score can help you get loans and credit cards at better interest rates, so it is essential to maintain a good credit score by making timely payments, keeping credit utilization low, and maintaining a diverse credit mix.